A practical guide to preparing Section 110 Certificates, covering timing, disclosure, and common risks that impact settlement and trust integrity.

Clear, accurate financial disclosure at settlement is critical. A Section 110 Certificate provides a purchaser with key financial information relating to the lot they are acquiring, and once settlement occurs, responsibility for those charges transfers with the title.

Because of this, accuracy, timing, and communication matter far more than many realise.

These guidelines reflect Veritas Strata Solutions’ experience-based approach to preparing Section 110 Certificates in a way that supports smooth settlements, reduces disputes, and protects the integrity of trust accounting.

These are practice guidelines, not legislative standards.

A Section 110 Certificate must accurately reflect the financial position of the lot as at the Date of Certificate.

Your role is to ensure:

The aim is not simply to produce a document, but to support an informed and dispute-free settlement process.

When issuing a Section 110 Certificate, always advise the settlement agent of:

This applies even where the due date falls after settlement. If invoices or levies are raised after the Certificate is issued but before settlement, forward them to the settlement agent immediately.

Proactive communication prevents last-minute disputes where neither party wishes to accept responsibility for charges issued close to settlement.

As a practice standard, the Section 110 fee should be paid before the Certificate is issued.

Recommended workflow:

Ensure the fee is always charged:

Do not issue invoices, provide information, or process requests for the incoming owner prior to settlement.

If access devices are requested:

This avoids confusion around ownership and protects the Strata Company from liability.

Where possible, issue the Certificate within one month of the proposed settlement date.

This is particularly important for schemes with sub-metering, where upcoming charges may otherwise be omitted.

If a settlement agent requests a Certificate well in advance:

If an early Certificate is insisted upon:

The Certificate must be complete, accurate, and supported by appropriate documentation.

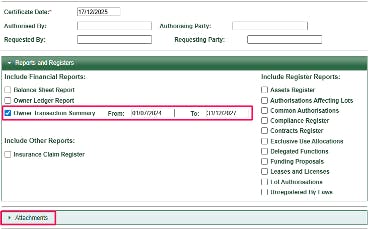

Levy Notice

Owner Ledger / Transaction Summary

Certificate of Currency

Optional supporting documents:

Date of Certificate

Confirms the date the information is accurate. Charges raised after this date must be communicated separately.

Date Paid To

Shows the levy period covered. Notify the settlement agent if payments are received after issue.

Special Levies

List all instalments, amounts, due dates, and payment status.

Sub-Meter Charges

Include:

Sub-meter invoices are not split by the Strata Manager. Apportionment is the responsibility of the settlement agent.

When determining payment status:

Interest should be calculated as at the proposed settlement date, not the Date of Certificate, to provide a more accurate settlement position.

Always manually review the ledger — merge fields should not be relied upon alone.

Section 110 Certificates are more than a formality — they are a critical point of financial disclosure that directly impacts settlement outcomes.

By applying consistent, experience-based practices, strata professionals can reduce disputes, protect trust integrity, and ensure clarity for all parties involved.

Together with Veritas, let’s build clarity, accuracy, and confidence into strata financial operations.